cumulative preferred stock meaning

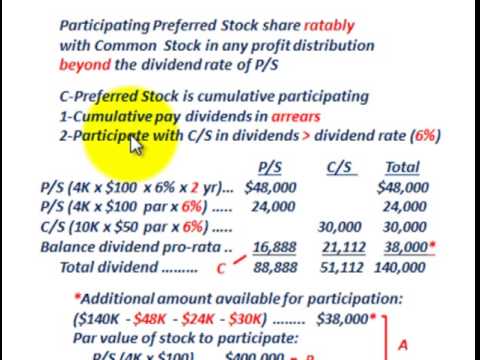

Cumulative Preferred stockholders get a fixed dividend rate irrespective of the. Preferred Stock Dividends Beachman Inc.

Definition of Cumulative Preferred Stock.

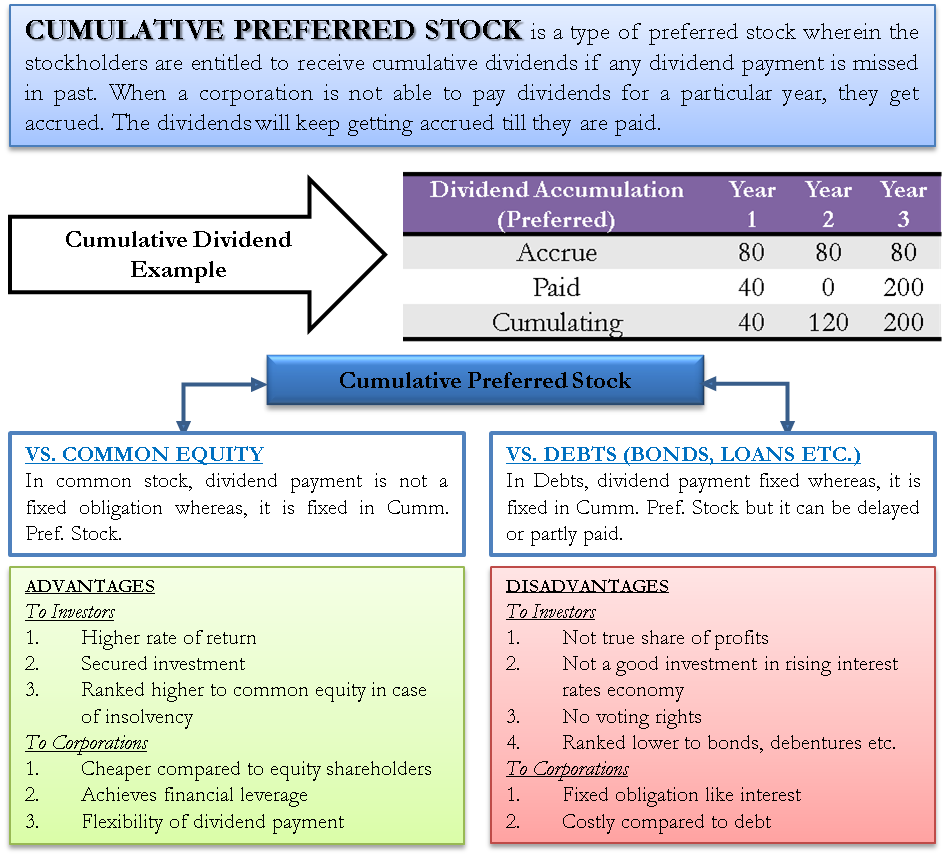

. Switch to new thesaurus. Cumulative preferred stock is a type of preferred stock with a provision that stipulates that if any dividend payments have been missed in the past the dividends owed must be paid out to. Cumulative preferred stock definition.

Preferred cumulative stock Vs Debt. When it is delayed the company may fall under bankruptcy logic. Typically the corporations board of directors will not declare a dividend they will be omitting.

There is an additional definition in the world law dictionary. Cumulative preferred stock requires that dividends for the current year and any unpaid dividends from prior years be paid to preferred. This means that the company is supposed to pay all the dividends including the ones that were previously not paid out to these cumulative.

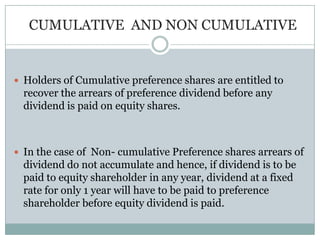

Cumulative Preferred Stocks are a type of preferred stock that abides the company to pay all the dividends for this type of shareholders before paying any other shareholder of the company. In other words its a type of preferred stock that has a right to a specific amount of dividends each year. Cumulative preferred stock - preferred stock whose dividends if omitted accumulate until paid out.

At the end of 2007 the cumulative dividend not paid is 32000 100000 8 4 years. Preferred stock whose dividends if omitted accumulate until paid out. However such stocks are costlier do not have voting rights and cannot demand the interim dividends.

Assume 10000 shares of 10 par 8 cumulative preferred stock has not paid dividends from 112004 to 12312007. This means that shareholders do not have a claim on any of the dividends that were not paid out. That is all dividends that were skipped must be paid to cumulative preferred stockholders before any dividends are paid to common stock holders.

All preferred dividends in arrears must be paid before common stockholders can receive distributions. The preferred stock is cumulative. Thus a 5 dividend on preferred shares that have a 100 par value equates to a 5 dividend.

They have precedence over common dividends. Cumulative preferred stock is a type of preferred stock for which any omitted dividends must be paid before the corporation is allowed to pay a dividend on its shares of common stock. Annual dividend on preferred stock.

A cumulative preferred stock is a type of preferred stock wherein the stockholders are entitled to receive cumulative dividends if any dividend payment is missed in past. Has 10900 shares outstanding of 10 20 par value cumulative preferred stock. If net income for the 2015 2016 and 2017 were 45 million 85 million and 10 million.

2 days agoIn addition the Board of Directors has authorized and the Company has declared a quarterly cash dividend on the Companys 7625 Series C Cumulative Redeemable Preferred Stock the Series C. Cumulative preferred stock definition. To Cumulative preference shareholders there is an obligation to pay them the dividends but a relaxation that it can be delayed or being partly paidRather in any kind of Debt it is mandatory to pay interest fee in the accrual year.

Cumulative preferred stock definition. If a company misses a dividend payment for any reason it still owes it to cumulative preferred stockholders. If the preferred stock is cumulative.

Convertible preferred stock is preferred stock that includes an option for the holder to convert the preferred shares into a fixed number of common shares usually any time after a predetermined. Cumulative preferred stock is a class of stock that where undeclared dividends are allowed to accumulate until they are paid. This is an advance summary of a forthcoming entry in the Encyclopedia of Law.

Usually the issuing company cannot issue dividends to the holders of its common stock in the same year. In this case the cumulative dividend on 6 preferred stock will be paid first to preferred stockholders and the remaining amount will then be deemed available for distribution to common. 160000 06 9600.

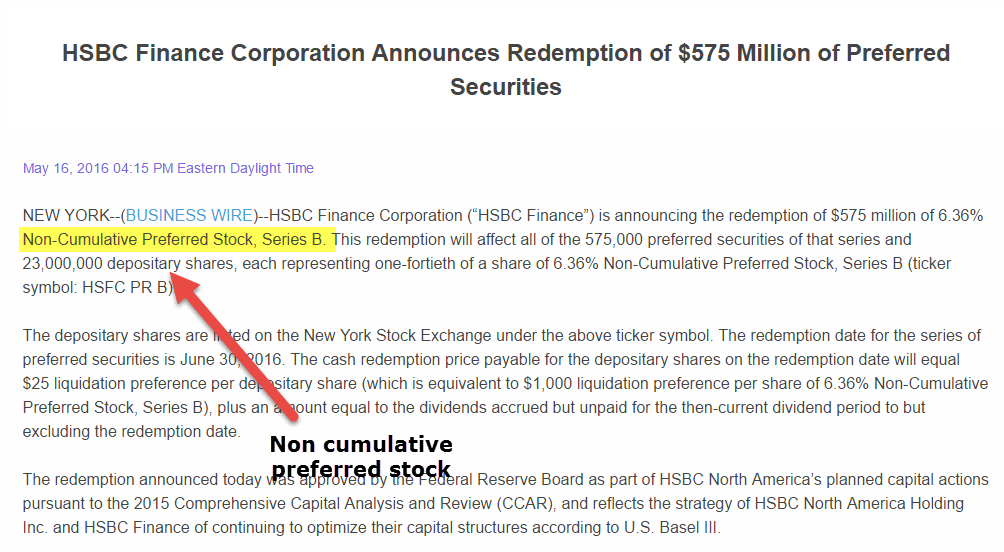

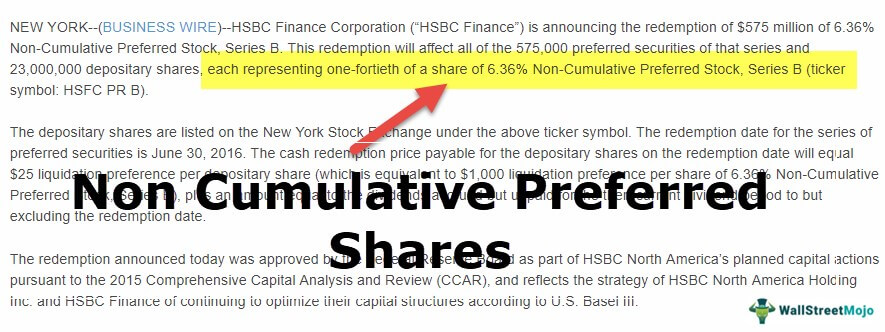

Cumulative preferred stock is a type of preferred stock for which any omitted dividends must be paid before the corporation is allowed to pay a dividend on its shares of common stock. Noncumulative preferred stock allows the issuing company to skip dividends and cancel the companys obligation to eventually pay those dividends. Preferred stock for which the publicly-traded company must pay all dividends.

The amount of the dividend is usually based on the par value of the stock. Cumulative preferred stock is an equity instrument that pays a fixed dividend on a predetermined schedule and prior to any distributions to the holders of a companys common stock. Ad Directory of Preferred Stocks including detailed yield and other data.

Cumulative Preferred Stock Cumulative Preferred Stock. Non-cumulative preferred stock. When a corporation is not able to pay dividends for a particular year they get accrued.

Meaning Characteristics Advantages Criticisms and More Plowback. Any omitted dividends on cumulative preferred stock are referred to as dividends in arrears and must be disclosed in the notes to the financial. Preference shares preferred shares preferred stock - stock whose holders are guaranteed priority in the payment of dividends but whose holders have no voting rights.

Cumulative preferred stock are those class of shares wherein any unpaid or undeclared dividends for the current. If the preferred stock is noncumulative. Cumulative preferred stock are those class of shares wherein any unpaid or undeclared dividends for the current year must be accumulated and paid for in the future.

If the dividends arent declared or paid the stock can accumulate the unpaid dividends for a future date when they are declared. Dividends on the cumulative preferred stock must be paid out before any dividends are paid to. This preferred stock feature assures the owner that any omitted dividends on this stock will be made up before the common stockholders will receive a dividend.

Cumulative preferred stock Preferred stock whose dividends accrue should the issuer not make timely dividend payments. Examples of 6 Cumulative Preferred Stock in a sentence Zapata redeemed the remaining balance of its outstanding 6 Cumulative Preferred Stock at 100 per share for 23 million in 1995 and repurchased 225 million shares of Common Stock from Norex for 400 per share. Find out preferred dividends paid in each year and the amount if any available for distribution to common stockholders.

In 2011 and 2012 no dividends. This preferred stock feature assures the owner that any omitted dividends on this stock will be made up before the common stockholders will receive a.

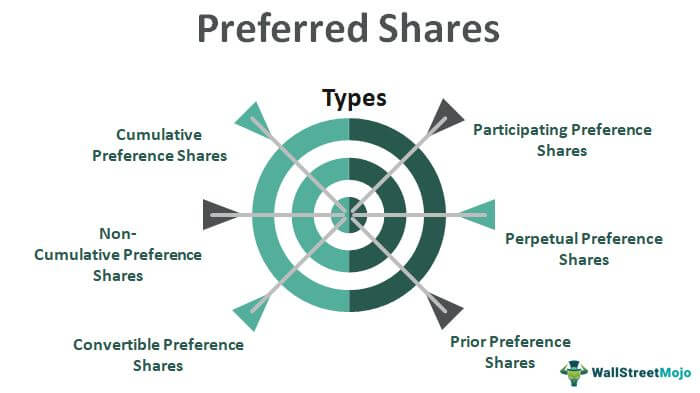

Preferred Shares Meaning Examples Top 6 Types

What Is Preferred Stock Robinhood

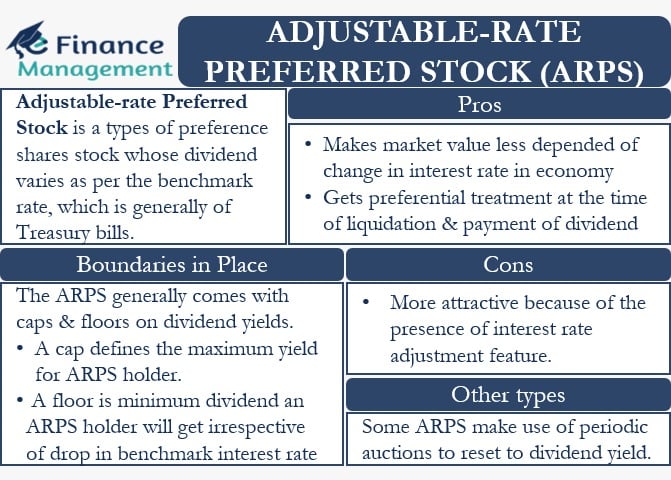

Adjustable Rate Preferred Stock Meaning Pros Cons And More

Preferred Shares Types Features Classification Of Shares

/book-with-page-about-preferred-stock--trading-concept--814447584-db8f837c330d4d8e9974c345d342867d.jpg)

Noncumulative Definition And Examples

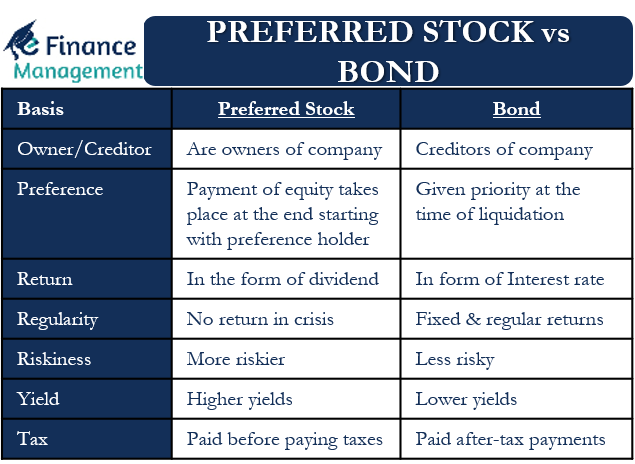

Preferred Stock Vs Bond Meaning Differences And More Efm

Preferred Shares Meaning Examples Top 6 Types

Preferred Shares Meaning Examples Top 6 Types

What Is Preferred Stock Definition Types Advantages Video Lesson Transcript Study Com

Cumulative Preferred Stock Definition Business Example Advantages

Common Shares Vs Preferred Shares Comparison Of Equity Types

Non Cumulative Preference Shares Advantages And Disadvantages

Non Cumulative Preference Shares Stock Top Examples Advantages

Preferred Stock Cumulative Fully Participating Allocating Dividends Between P S C S Youtube

Cumulative Preferred Stock Definition

Preferred Stock Cumulative Vs Noncumulative Participating Vs Nonparticipating Dividends Youtube

Cumulative Preferred Stock Define Example Benefits Disadvantages

Preferred Stock Cumulative Vs Noncumulative Participating Vs Nonparticipating Dividends Youtube